Republican plan

$1.1 trillion

Already passed

$3.2 trillion

Democratic plan

$3.4 trillion

Small-business aid

$158 billion

$1,010 billion

$0 billion

Other measures

81

627

302

203

346

36

Business tax breaks

Stimulus checks

300

293

436

111

277

382

Health care

110

274

437

Unemployment benefits

State and local aid

105

256

1,118

Safety net and other tax cuts

18

83

736

Republican plan

$1.1 trillion

Already passed

$3.2 trillion

Democratic plan

$3.4 trillion

Small-business aid

$158 billion

$1,010 billion

$0 billion

Other measures

81

627

302

203

346

36

Business tax breaks

Stimulus checks

300

293

436

111

277

382

Health care

110

274

437

Unemployment benefits

State and local aid

105

256

1,118

Safety net, other tax cuts

18

83

736

Already

passed

$3.2 trillion

Republican

plan

$1.1 trillion

Democratic

plan

$3.4 trillion

158

627

81

302

346

203

36

293

300

436

277

111

382

274

110

437

256

105

1,118

83

18

736

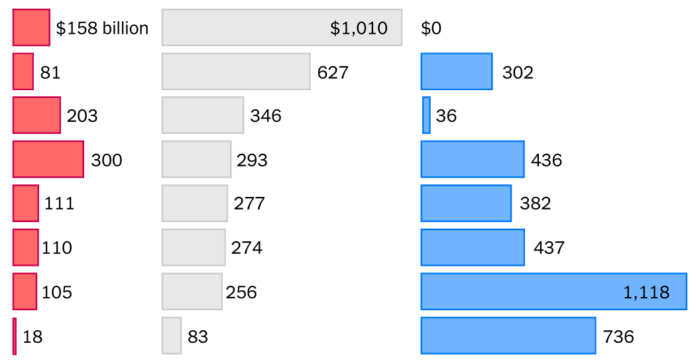

Analysis of data from The Committee for a Responsible Federal Budget. About $800 billion of the aid that has already passed, primarily in the form of loans, is not expected to add to the deficit.

There is little overlap in the plans released by Democrats and Republicans for another round of federal aid to address the Covid-19 pandemic. The House Democrats’ opening offer, a $3.4 trillion package that passed the chamber in May, would extend $600 weekly unemployment payments and provide $1 trillion more in state and local aid.

The Senate Republican plan, a $1.1 trillion package announced Monday, includes scaled-back unemployment benefits and more funding for small-business loans.

The Republican bill has not yet received an official cost projection, but the Committee for a Responsible Federal Budget has analyzed both measures. Here, based on that data, is how the two parties’ proposals compare with each other and with the more than $3 trillion in federal support passed by Congress since March:

Unemployment Benefits

Congress is facing increasing pressure to come to an agreement because weekly unemployment benefit payments of $600 expire for millions of Americans this week. Republicans have proposed reducing the additional benefit, which is added to regular state payments, to $200 per week through September, with a plan to set total benefits at 70 percent of lost income after that. Democrats want to continue the higher payments through January.

Republican plan

Already passed

Democratic plan

Additional $600/week payments through July $176 billion

Extend

reduced

benefits

$110 billion*

Extend and expand benefits

$437 billion

Extend benefits to self-employed and others

$35b

Up to 13 additional weeks of benefits $51b

Other $12b

Republican plan

Already passed

Democratic plan

Additional $600/week payments through July $176 billion

Extend

reduced

benefits

$110b*

Extend and expand benefits

$437 billion

Extend benefits to self-employed and others

$35b

Up to 13 additional weeks of benefits $51b

Other $12b

Republican plan

Already passed

Democratic plan

Additional $600/week payments through July $176 billion

Extend

reduced

benefits

$110

billion*

Extend and expand benefits

$437 billion

Up to 13 additional weeks of benefits $51b

Extend benefits to self-employed and others

$35b

Other $12b

Already passed

Up to 13 additional weeks of benefits $51b

Additional $600/week payments through July $176 billion

Extend benefits to self-employed and others $35b

Other $12b

Republican plan

Extend reduced benefits

$110 billion*

Democratic plan

Extend and expand benefits

$437 billion

*The budget analysts note that this estimate is rough, and actual costs could differ substantially.

Second Round of Stimulus Checks

Both parties include a second round of stimulus checks for individuals. The Democratic plan is more costly, increasing the amount allotted for dependents to $1,200 from $500 and loosening rules to allow undocumented immigrants to receive money.

Republican plan

Already passed

Democratic plan

Second round of stimulus checks

$300 billion

Stimulus checks

$293 billion

Second round of stimulus checks

$413 billion

Loosen rules for

stimulus checks $23b

Republican plan

Already passed

Democratic plan

Second round of stimulus checks

$300 billion

Stimulus checks

$293 billion

Second round of stimulus checks

$413 billion

Loosen rules for

stimulus checks $23b

Republican plan

Already passed

Democratic plan

Second round of stimulus checks

$300 billion

Stimulus checks

$293 billion

Second round of stimulus checks

$413 billion

Loosen rules for

stimulus checks $23b

Already passed

Stimulus checks

$293 billion

Republican plan

Second round of stimulus checks

$300 billion

Democratic plan

Second round of stimulus checks

$413 billion

Loosen rules for stimulus checks $23b

Small-Business Aid

Republicans have proposed more funding for Paycheck Protection loans, in addition to two other lending programs for small businesses. Democrats have not proposed additional loans.

Republican plan

Already passed

“Second draw” Paycheck Protection loans $90b

Emergency small

business loans

$300 billion

Paycheck Protection loans

$670 billion

Recovery sector loans for struggling businesses $58b

Existing loan

subsidies $17b

New small business

investment facility $10b

Small Business

Administration $2b

Republican plan

Already passed

“Second draw” Paycheck Protection loans $90b

Emergency small

business loans

$300 billion

Paycheck Protection loans

$670 billion

Recovery sector loans for struggling businesses $58b

Existing loan

subsidies $17b

New small business

investment facility $10b

Small Business

Administration $2b

“Second draw” Paycheck Protection loans $90b

Emergency small

business loans

$300 billion

Paycheck Protection loans

$670 billion

Recovery sector loans for struggling businesses $58b

Existing loan

subsidies $17b

New small business

investment facility $10b

Small Business

Administration $2b

Already passed

Paycheck Protection loans

$670 billion

Emergency small

business loans

$300 billion

Existing

loan

subsidies

$17b

Small Business

Administration $2b

Republican plan

Recovery sector loans for struggling businesses $58b

“Second draw” Paycheck Protection loans $90b

New small business

investment facility $10b

Aid to State and Local Governments

Democrats have proposed nearly $1 trillion in additional aid to state and local governments to help make up for reduced revenue and increased spending during the pandemic. Both parties propose granting additional funds to states for education, but the Republican plan favors schools that hold in-person classes.

Republican plan

Already passed

Democratic plan

More

Medicaid

funding

$81b

State and local

government aid

$150 billion

More state and local government aid

$915 billion

Education funding $31b

More

education

funding

$90b

Infrastructure grants

$25b

Infrastructure and public

transportation $32b

More education

funding $105b

More

Medicaid

funding

$81b

State and local

government aid

$150 billion

More state and local government aid

$915 billion

Education funding $31b

More

education

funding

$90b

Infrastructure grants

$25b

Infrastructure and public

transportation $32b

More education

funding $105b

More

Medicaid

funding

$81b

State and local

government aid

$150 billion

More state and local government aid

$915 billion

Education funding $31b

More

education

funding

$90b

Infrastructure grants

$25b

Infrastructure and public

transportation $32b

More education

funding $105b

Already passed

State and local

government aid

$150 billion

Infrastructure grants

$25b

Republican plan

More education funding $105b

Democratic plan

More state and local government aid

$915 billion

More education

funding $90b

More Medicaid

funding $81b

Infrastructure and public transportation $32b

Note: Infrastructure grants passed in March were for transit providers, which include state and local governments.

Safety Net and Individual Tax Cuts

Democrats included hundreds of billions of dollars in spending on priorities like safety-net programs, and are calling for the temporary elimination of the cap on the state and local tax deduction that primarily affects blue states.

Republican plan

Already passed

Democratic plan

Eliminate SALT deduction cap for two years

$137 billion

Hazard pay fund for

essential workers

$190 billion

Child care and development grants $15b

More housing support

$202 billion

Increase child tax credit benefits $119 billion

Other $8b

More food

assistance $35b

Tax credits and deductions for workers and child care $35b

Expand use of health savings accounts $9b

Emergency retirement withdrawals $8b

Eliminate SALT deduction cap for two years

$137 billion

Child

care and develop-

ment

grants

$15b

Hazard pay fund for

essential workers

$190 billion

More housing support

$202 billion

Increase child tax credit benefits

$119 billion

Other $8b

More food

assistance $35b

Tax credits and deductions for workers and child care $35b

Expand use of health savings accounts $9b

Emergency retirement withdrawals $8b

Eliminate SALT deduction cap

for two years

$137 billion

Hazard pay fund for

essential workers

$190 billion

Child

care and develop-

ment

grants

$15b

More housing

support

$202 billion

Increase child tax credit benefits

$119 billion

Other $8b

More food

assistance $35b

Tax credits and deductions for workers and child care $35b

Expand use of health savings accounts $9b

Emergency retirement withdrawals $8b

Already passed

Expand use of health savings accounts $9b

Other $8b

Food assistance $46b

Emergency retirement withdrawals $8b

Republican plan

Child care and development

grants $15b

Democratic plan

Increase child tax credit benefits

$119 billion

Eliminate SALT deduction cap for two years

$137 billion

More food

assistance

$35b

Hazard pay fund for

essential workers

$190 billion

More housing support

$202 billion

Tax credits and deductions for workers and child care $35b

Health Care

Both parties have included additional health care spending in their plans. Democrats propose more spending over all, including nearly $100 billion to subsidize continuing health insurance coverage for laid-off workers under COBRA, the Consolidated Omnibus Budget Reconciliation Act.

Republican plan

Already passed

Democratic plan

More health agency, community health funding $32b

Reimburse providers for lost revenue and expenses

$100 billion

Health provider funding

$175 billion

Covid-19 treatment cost support

$90b

More

Covid-19 testing and contact tracing

$75b

More health provider funding

$25b

Vaccines, therapeutics, diagnostics $26b

COBRA payments for laid-off workers

$98 billion

Veterans

and

defense

health

$20b

Health agency,

community

health funding

$45b

More

Covid-19

testing

$16b

R&D $3b

More health agency, community

health funding $19b

Republican plan

Already passed

Democratic plan

More health agency, community health funding $32b

Reimburse providers for lost revenue and expenses

$100 billion

Health provider funding

$175 billion

More

Covid-19 testing and contact tracing

$75b

Covid-19 treatment cost support

$90b

More health provider funding

$25b

Vaccines, therapeutics, diagnostics $26b

COBRA payments for laid-off workers

$98 billion

Veterans

and

defense

health

$20b

Health agency,

community

health funding

$45b

More

Covid-19

testing

$16b

R&D $3b

More health agency, community

health funding $19b

Republican plan

Already passed

Democratic plan

More health agency, community health funds $32b

Reimburse providers for lost revenue and expenses

$100 billion

Health provider funding

$175 billion

More

Covid-19 testing and contact tracing

$75b

Covid-19 treatment cost support

$90b

More health provider funding

$25b

Vaccines, therapeutics, diagnostics $26b

COBRA payments for laid-off workers

$98 billion

Health agency, community

health funding $45b

Veterans

and

defense

health

$20b

More

Covid-19

testing

$16b

R&D $3b

More health agency, community

health funding $19b

Already passed

Health agency, community

health funding $45b

Health provider funding

$175 billion

Veterans and

defense health $20b

R&D $3b

Republican plan

More health agency, community health funds $32b

Vaccines, therapeutics, diagnostics $26b

More Covid-19

testing $16b

More health provider funding $25b

Democratic plan

Reimburse providers for lost revenue and expenses

$100 billion

COBRA payments for laid-off workers

$98 billion

Covid-19 treatment cost support $90b

More Covid-19 testing and contact tracing $75b

More health agency, community

health funding $19b

Note: Congress also passed changes to Medicare in March that will result in an estimated net spending reduction over 10 years.

Business Tax Credits and Deductions

Both parties have proposed expanding a payroll tax credit passed in March, with slightly different parameters.

Republican plan

Already passed

Democratic plan

Paid leave tax credit

$105 billion

Expanded tax credit to retain workers

$100 billion

Expanded tax credit to retain workers $164 billion

Tax credit to retain workers $55b

Tax credit to encourage hiring $50b

Loosen caps on interest deductibility and losses*

$174 billion

Extend and expand paid leave credit $32b

Credits for employer expenses and closed businesses

$73b

Tax credit for Covid-19 protection expenses $50b

Restaurant expense

deduction $3b

Delay payroll taxes $12b

Tax credit for self-employed $21b

Republican plan

Already passed

Democratic plan

Paid leave tax credit

$105 billion

Expanded tax credit to retain workers

$100 billion

Tax credit to retain workers $55b

Expanded tax credit to retain workers $164 billion

Tax credit to encourage hiring $50b

Loosen caps on interest deductibility and losses*

$174 billion

Extend and expand paid leave credit $32b

Credits for employer expenses and closed businesses

$73b

Tax credit for Covid-19 protection expenses $50b

Delay payroll taxes $12b

Restaurant expense

deduction $3b

Tax credit for self-employed $21b

Republican plan

Already passed

Democratic plan

Paid leave tax credit

$105 billion

Expanded tax credit to retain workers

$100 billion

Expanded tax credit to retain workers $164 billion

Tax credit to retain workers $55b

Tax credit to encourage hiring $50b

Loosen caps on interest deductibility and losses*

$174 billion

Extend and expand paid leave credit $32b

Credits for employer expenses and closed businesses

$73b

Tax credit for Covid-19 protection expenses $50b

Restaurant expense

deduction $3b

Delay payroll taxes $12b

Tax credit for self-employed $21b

Already passed

Tax credit to retain workers $55b

Paid leave

tax credit

$105 billion

Loosen caps on interest deductibility and losses*

$174 billion

Delay payroll taxes $12b

Republican plan

Tax credit for Covid-19 protection expenses $50b

Expanded tax credit to retain workers

$100 billion

Tax credit to encourage hiring $50b

Restaurant expense

deduction $3b

Democratic plan

Credits for employer expenses and closed businesses $73b

Expanded tax credit to retain workers

$164 billion

Extend and expand paid leave credit $32b

Tax credit for self-employed $21b

*Democrats have proposed raising $254 billion by reversing this measure passed in March and further limiting business loss deductibility.·The budget analysts note that estimates for the tax credit provisions in the Republican plan are rough, and actual costs could differ substantially.

Other Provisions

Both plans contain a handful of other line items. Some Republican senators were surprised to learn that their plan included $1.75 billion for a new F.B.I. headquarters — a White House demand without a connection to the pandemic.

Republican plan

Already passed

Democratic plan

Loans to airlines and national security firms $46b

Other higher education

funding $169 billion

Airports $10b

Support for $4.5 trillion in

Federal Reserve loans

$454 billion

Changes to retirement

and pension plans

$48b

Other $7b

Student loan

forgiveness

$22b

International

assistance $4b

Defense Production

Act purchases $5b

Aviation tax

suspension $4b

F.B.I. headquarters $2b

Republican plan

Already passed

Democratic plan

Loans to airlines and national security firms $46b

Other higher education

funding $169 billion

Airports $10b

Support for $4.5 trillion in

Federal Reserve loans

$454 billion

Changes to retirement and pension plans $48b

Other $15b

Defense

contract-

ors $11b

Other $7b

Student loan

forgiveness

$22b

Aviation tax

suspension $4b

International

assistance $4b

Defense Production

Act purchases $5b

F.B.I. headquarters $2b

Loans to airlines and national security firms $46b

Other higher education

funding $169 billion

Airports $10b

Support for $4.5 trillion in

Federal Reserve loans

$454 billion

Changes to retirement and pension plans $48b

Other $15b

Defense

contract-

ors $11b

Other $7b

Student loan

forgiveness

$22b

Aviation tax

suspension $4b

International

assistance $4b

Defense Production

Act purchases $5b

F.B.I. headquarters $2b

Already passed

Support for $4.5 trillion in

Federal Reserve loans

$454 billion

Loans to airlines and national security firms $46b

Aviation tax

suspension $4b

Republican plan

F.B.I.

Other $15b

Airports $10b

Defense Production

Act purchases $5b

Democratic plan

Changes to retirement and pension plans $48b

Other higher education

funding $169 billion

Student

loan

forgive-

ness $22b

Other $7b