A brand-new small business rescue package taking shape quickly on Capitol Hill is anticipated to consist of $25 billion to expand coronavirus testing, however how to structure that cash became a final sticking point to the offer on Monday.

In the middle of an outcry and finger-pointing over the accessibility of tests, Democrats were pushing for a “extensive nationwide screening method,” Senate Minority Leader Charles E. Schumer (D-N.Y.) stated over Twitter. The Democrats were seeking “free testing for all, and expanding reporting and contact tracing,” Schumer said.

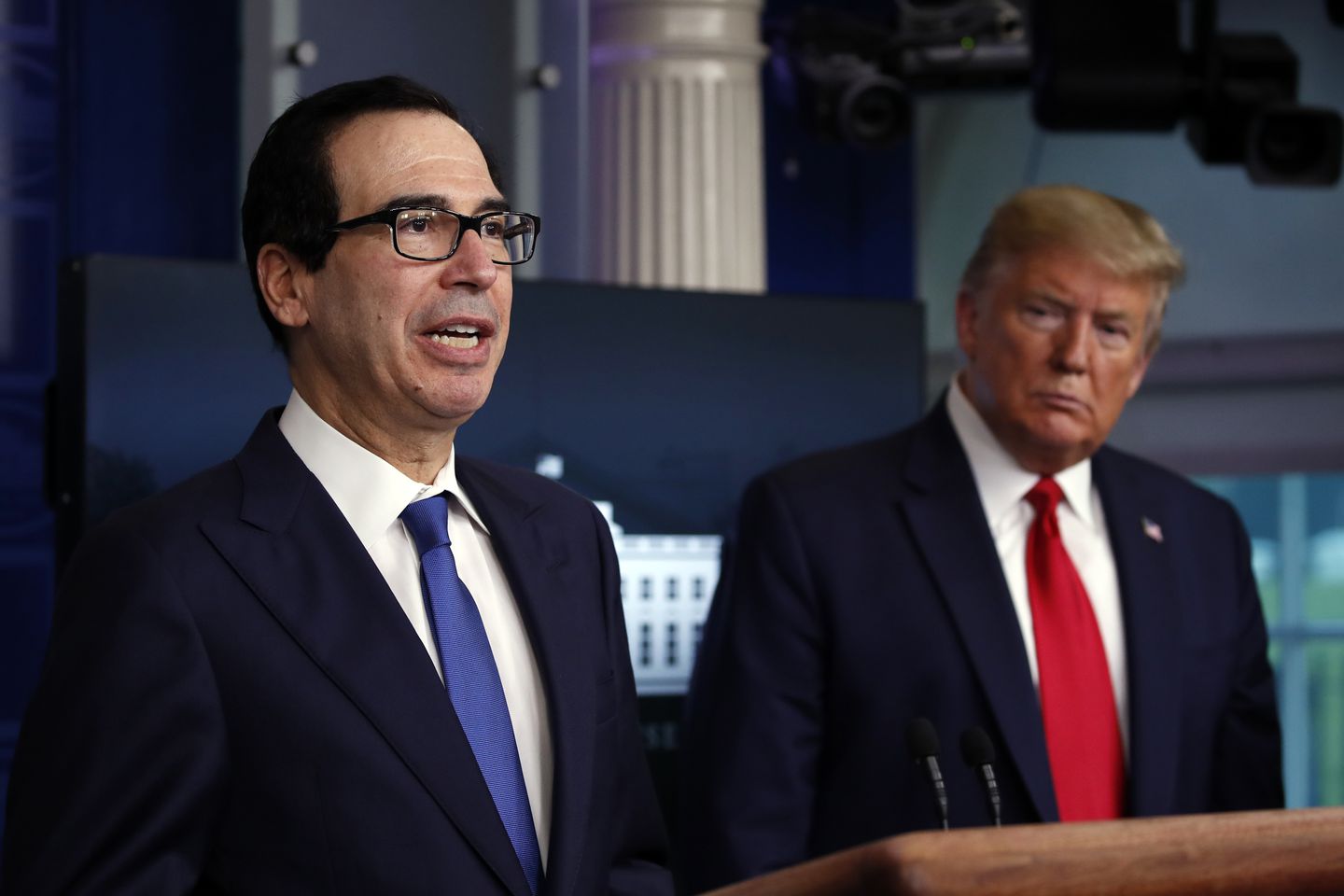

But Treasury Secretary Steven Mnuchin and other Trump administration authorities were seeking a “state-driven method and versatility,” according to a senior administration authorities, who spoke on condition of privacy to describe the personal talks.

The differing methods echoed the conflict growing nationally, as guvs blame the federal government for the lack of tests, while President Trump and other administration officials insist there have been record numbers of tests carried out which governors require to attempt more difficult.

The disagreement was one of numerous holding up conclusion of the offer that would dedicate around another $370 billion to emergency situation small business loans and grants, and likewise boost financing for hospitals by $75 billion as legislators battle to overtake the coronavirus pandemic’s health and economic effect.

The package comes several weeks after Congress dedicated a record $2 trillion to jailing the economic fallout from the coronavirus, underscoring the depth of the crisis and the growing demand for a robust federal reaction. More than 22 million individuals have actually lost their tasks in the last month as the economy nose-dives into a recession.

The Income Defense Program was initially moneyed at $349 billion in Congress’s $2 trillion financial rescue expense, but it ran dry last Thursday and the Small company Administration stopped accepting loan applications. Partisan quarreling ensued as Democrats blocked Republican politicians from passing a straight funding boost without getting something in return.

The White Home had actually initially sought to increase the Small company Administration’s Income Protection Program by $251 billion, but Democrats required additional modifications, which contributed to the legislation’s size and scope. Republicans declined Democrats’ effort to include $150 billion for city and state budget plans that have actually been knocked by the pandemic, but consented to consist of $75 billion for hospitals and $25 billion for testing.

As they completed the bundle, lawmakers were circling an increase of $310 billion for the Paycheck Protection Program, of which $60 billion would be reserved for smaller banks to disperse. Half of that would be provisioned for lending institutions with less than $10 billion in possessions and the other half for institutions with between $10 billion and $50 billion in properties. An additional $60 billion in loans and grants would go to a different small business emergency situation loaning program that is out of money.

Congressional assistants cautioned, nevertheless, that talks were ongoing and information remained in flux.

Legislators and the administration burnt the midnight oil into the night Sunday attempting to work out the arrangement, however Democrats stated Monday that problems stayed unsolved on the health center spending and some aspects of the small business programs. They likewise insisted they had actually not abandoned their push for some relief for state and local governments whose spending plans have been hollowed out by the pandemic, but Republicans and administration officials continued to decline those demands.

Sen. Marco Rubio (R-Fla.), the principal author of the Income Protection Program, said he wished for Senate passage later Monday, however that was looking unlikely. Votes are expected today, however, with Home Majority Leader Steny H. Hoyer (D-Md.) notifying Home members late Sunday that they should expect to return to the Capitol on Wednesday to vote on the legislation.

Both chambers run out session, however Republicans have actually made it clear they will insist on a roll-call vote in the House, which will require a bulk of lawmakers to be present. That might also provide Home Speaker Nancy Pelosi (D-Calif.) with a chance to press through the production of a brand-new choose committee to oversee the coronavirus reaction, in addition to a brand-new proxy ballot system that would essentially enable lawmakers to vote from afar by entrusting coworkers to vote for them.

In videos on Twitter and in an interview with CNBC, Rubio also defended the Paycheck Protection Program amid reports of large business getting loans, in some cases with more than one affiliate getting the maximum $10 million. The loans are supposed to go to companies with fewer than 500 employees and are forgivable if the businesses keep workers on their payrolls.

Rubio stated that some companies had been approved for loans that he didn’t believe should have but that he hoped policies would be tightened up to avoid that from occurring.

” Look, there were glitches made no doubt about it, however in the end bask in the truth that the money needs to go to the workers ultimately, it does not truly matter who the worker’s working for we wish to keep them utilized. This is not a bailout of any company,” Rubio said. “However I think certainly the goal here is to get cash into the hands of businesses who don’t have anywhere else to opt for money, consisting of the stock exchange, shareholders, other sort of credit lines.”

House Minority Leader Kevin McCarthy (R-Calif.) spoke in favor of the emerging agreement in an interview on Fox Organisation, accusing Democrats of holding it up to make a range of demands.

” What it would do is something that we’ve been asking for the last two weeks, more financing for the small business program,” McCarthy said. “This service program has actually worked effectively more than 1.6 million organisations requested the money to pay their workers, to pay their lease.”