Published on Apr 21, 2020

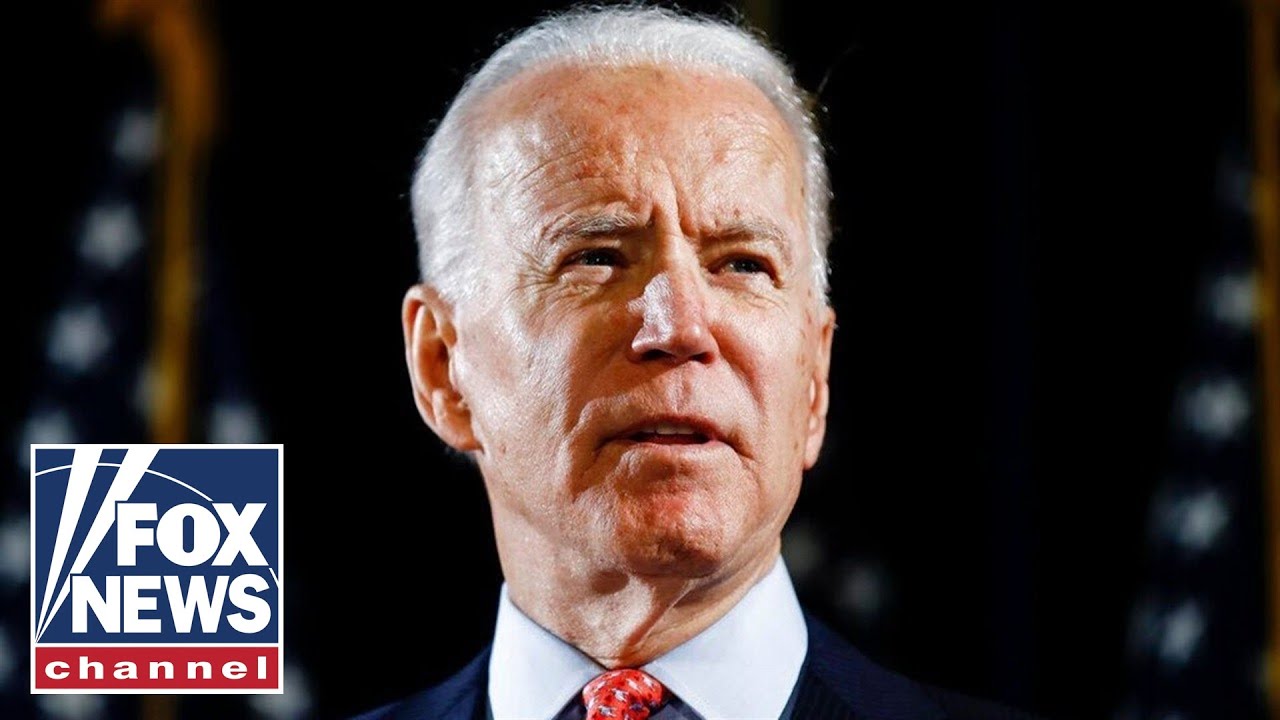

Joe Biden raises a campaign-best $467 million in March however is still far behind President Trump; reaction and analysis on ‘Outnumbered.’ #FoxNews

FOX News operates the FOX News Channel (FNC), FOX Business Network (FBN), FOX News Radio, FOX News Headings 24/ 7, FOXNews.com and the direct-to-consumer streaming service, FOX Nation. FOX News also produces FOX News Sunday on FOX Broadcasting Company and FOX News Edge. A top five-cable network, FNC has been the most-watched news channel in the country for 17 consecutive years. According to a 2018 Research study Intelligencer study by Brand Keys, FOX News ranks as the second most trusted tv brand in the nation. In addition, a Suffolk University/USA Today survey states Fox News is the most relied on source for television news or commentary in the country, while a 2017 Gallup/Knight Foundation study discovered that amongst Americans who might name an unbiased news source, FOX News is the top-cited outlet. FNC is available in nearly 90 million homes and dominates the cable news landscape while consistently notching the top ten programs in the category.

Subscribe to Fox News! https://bit.ly/2vBUvAS

Watch more Fox News Video: http://video.foxnews.com

Watch Fox News Channel Live: http://www.foxnewsgo.com/

Watch full episodes of your preferred shows

The 5: http://video.foxnews.com/playlist/lon …

Special Report with Bret Baier: http://video.foxnews.com/playlist/lon …

The Story with Martha MacCallum: http://video.foxnews.com/playlist/lon …

Tucker Carlson Tonight: http://video.foxnews.com/playlist/lon …

Hannity: http://video.foxnews.com/playlist/lon …

The Ingraham Angle: http://video.foxnews.com/playlist/lon …

Fox News @ Night: http://video.foxnews.com/playlist/lon …

Follow Fox News on Facebook: https://www.facebook.com/FoxNews/

Follow Fox News on Twitter: https://twitter.com/FoxNews/

Follow Fox News on Instagram: https://www.instagram.com/foxnews/

.